Payoneer vs WorldFirst vs TransferWise vs OFX vs AirWallex

Updates:

Oct 2021: I've been using Airwallex since Oct 2021. While I am satisfied with OFX's currency conversion rate, Airwallex matches their rate, plus has several additional features that OFX lacks. These include:

1 March 2021: Good news and bad news!

Good news:

OFX is offering a very low preferential currency conversion rate (which they told me I'm not allowed to publish publicly). You must use this link to get the special rate: https://bit.ly/ofxjasontayonline

OFX is also in Amazon's new Payment Service Provider (PSP) program.

Now the bad news (and why you should sign up with OFX).

1) WorldFirst has increased their fees. FX Margin (currency conversion rate spread/fees) increased on 19 Feb 2021. For example, those of you with 0.5% margin are now charged 0.6%.

2) For those who are unaware, beginning March 1, 2021, sellers adding a new bank account from a 3rd party payment service provider (PSP) must use a PSP participating in Amazon's PSP program.

TransferWise is NOT in the program as yet (they say they are working on it). Until and if TransferWise is accepted into Amazon PSP, this means that:

a) If you have not added TransferWise as a Deposit Method in Amazon Seller Central, you won't be able to add it starting 1st Mar 2021.

b) If you are already using TransferWise as a deposit method in Amazon Seller Central; any payments disbursed to TransferWise accounts after 31 May 2021 will be subject to a longer disbursement reserve of up to 21 days vs the normal reserve period of 7 days. (What's the reserve period? It's the number of days Amazon holds sales proceeds after an order is delivered before it's payable to sellers. This reserve period is to buffer for refunds)

Practically this means continuing to use TransferWise will result in a 14 day cash flow delay.

---------------------------

Conclusion: Based on lower FX rates and the launch of Amazon's PSP program, I would recommend switching to OFX for your currency conversion needs.

To sign up for OFX at the preferential 0.3% rate go to https://bit.ly/ofxjasontayonline

For a more details, read the rest of this page.

--------------------------

28 Feb 2021: OFX is offering a very low preferential currency conversion rate of 0.X% (I'm not allowed to publish the rate as it is below than any other rate they officially offer) to anyone who signs up through this link: OFX preferential rate.

19 Feb 2021: WorldFirst is revising their FX margins higher.

2 Feb 2021: Amazon announced the launch of the Amazon Payment Service Provider (PSP) program.

8 Oct 2020: Amazon announces lower fees of 1.5% for disbursements directly into your home country bank accounts (Ref: https://sellercentral.amazon.com/gp/help/external/G200381250?language=en_US)

Old Updates (no longer applicable):

7 August 2019, WorldFirst is revising their rates lower and their new pricing is much better for us!

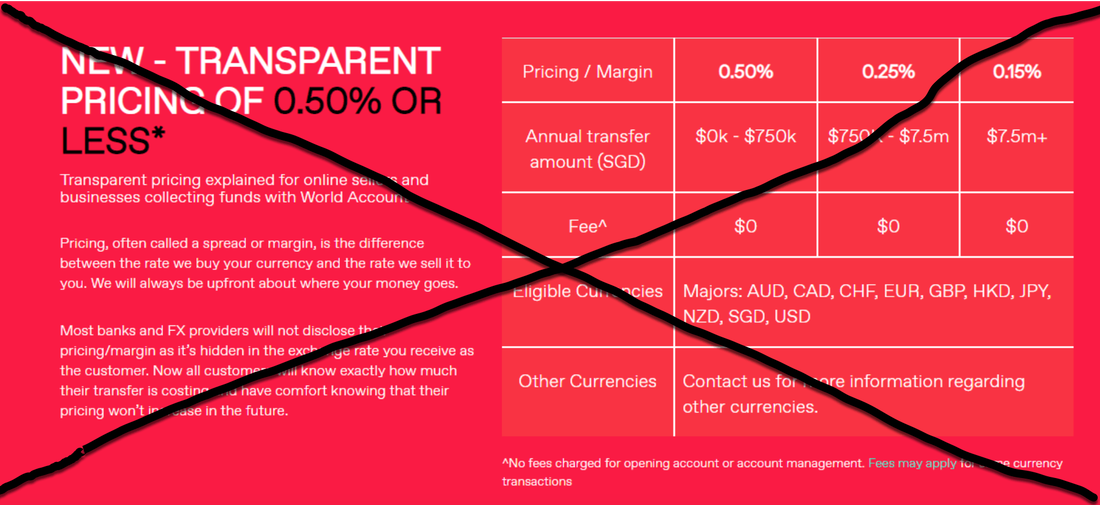

The forex spread (aka exchange rate or "fees" if you wan to call it that) for international transfers starts from just 0.5% or less. If you transfer more, the rate is even lower! I am now paying just 0.25% for all my foreign exchange transfers, which is great!

In addition to using it for receiving your payouts or disbursements from Amazon, you can also use it for personal transfers such as transferring funds for your child's overseas education or property investment. The rate is much better than any bank can offer, even for premier, priority or privilege clients.

Have a look at the rate table below for the new pricing structure.

You can click the button below to sign up for a free WorldFirst account. There are no fees charged for account opening and no minimum balance to maintain, unlike some banks. WorldFirst only makes the 0.15% to 0.50% margin when you convert and send money through them.

Oct 2021: I've been using Airwallex since Oct 2021. While I am satisfied with OFX's currency conversion rate, Airwallex matches their rate, plus has several additional features that OFX lacks. These include:

- Zero fx fees for same currency transfers (eg. USD to USD). Only SWIFT fee for international transfers. This means free ACH transfers to US suppliers and 3PLs, and no 0.3% fee when paying your non-US suppliers in USD from your USD account balance.

- Visa debit cards - zero fees for same currency transactions, and low Airwallex FX fees if involving currency conversion vs high bank credit/debit card fees.

- Xero integration for easier bookkeeping and accounting.

- Better currency conversion rate compared to most other service providers like Payoneer, Wise, World First, etc..

- Issuing invoices.

- Payment processing for Woocommerce and Magento with lower fees vs Stripe and PayPal.

- Zero fees for first AUD20k or equivalent in transfers if you sign up through this link to Airwallex.

1 March 2021: Good news and bad news!

Good news:

OFX is offering a very low preferential currency conversion rate (which they told me I'm not allowed to publish publicly). You must use this link to get the special rate: https://bit.ly/ofxjasontayonline

OFX is also in Amazon's new Payment Service Provider (PSP) program.

Now the bad news (and why you should sign up with OFX).

1) WorldFirst has increased their fees. FX Margin (currency conversion rate spread/fees) increased on 19 Feb 2021. For example, those of you with 0.5% margin are now charged 0.6%.

2) For those who are unaware, beginning March 1, 2021, sellers adding a new bank account from a 3rd party payment service provider (PSP) must use a PSP participating in Amazon's PSP program.

TransferWise is NOT in the program as yet (they say they are working on it). Until and if TransferWise is accepted into Amazon PSP, this means that:

a) If you have not added TransferWise as a Deposit Method in Amazon Seller Central, you won't be able to add it starting 1st Mar 2021.

b) If you are already using TransferWise as a deposit method in Amazon Seller Central; any payments disbursed to TransferWise accounts after 31 May 2021 will be subject to a longer disbursement reserve of up to 21 days vs the normal reserve period of 7 days. (What's the reserve period? It's the number of days Amazon holds sales proceeds after an order is delivered before it's payable to sellers. This reserve period is to buffer for refunds)

Practically this means continuing to use TransferWise will result in a 14 day cash flow delay.

---------------------------

Conclusion: Based on lower FX rates and the launch of Amazon's PSP program, I would recommend switching to OFX for your currency conversion needs.

To sign up for OFX at the preferential 0.3% rate go to https://bit.ly/ofxjasontayonline

For a more details, read the rest of this page.

--------------------------

28 Feb 2021: OFX is offering a very low preferential currency conversion rate of 0.X% (I'm not allowed to publish the rate as it is below than any other rate they officially offer) to anyone who signs up through this link: OFX preferential rate.

- I have just started using OFX this month

- OFX is in Amazon's Payment Service Provider (PSP) program

19 Feb 2021: WorldFirst is revising their FX margins higher.

- Rates are going up from 0.15-0.5% to 0.2-0.6%

- There will be a fall-below fee for withdrawals

2 Feb 2021: Amazon announced the launch of the Amazon Payment Service Provider (PSP) program.

- The last time I checked (28 Feb 2021), TransferWise was NOT yet in the Amazon PSP program. This means sellers will not be able to add bank accounts from TransferWise from 1 March 2021.

- Sellers who have an existing TransferWise bank account and continue to use it will be subject to a longer disbursement reserve period of up tp 21 days after the latest estimated delivery date, compared to the normal 7 day reserve period. This means an additional 14 days delay in the disbursement of sales proceeds if you do not use an Amazon PSP. (Ref: https://sellercentral.amazon.com/gp/help/G202124090)

8 Oct 2020: Amazon announces lower fees of 1.5% for disbursements directly into your home country bank accounts (Ref: https://sellercentral.amazon.com/gp/help/external/G200381250?language=en_US)

Old Updates (no longer applicable):

7 August 2019, WorldFirst is revising their rates lower and their new pricing is much better for us!

The forex spread (aka exchange rate or "fees" if you wan to call it that) for international transfers starts from just 0.5% or less. If you transfer more, the rate is even lower! I am now paying just 0.25% for all my foreign exchange transfers, which is great!

In addition to using it for receiving your payouts or disbursements from Amazon, you can also use it for personal transfers such as transferring funds for your child's overseas education or property investment. The rate is much better than any bank can offer, even for premier, priority or privilege clients.

Have a look at the rate table below for the new pricing structure.

You can click the button below to sign up for a free WorldFirst account. There are no fees charged for account opening and no minimum balance to maintain, unlike some banks. WorldFirst only makes the 0.15% to 0.50% margin when you convert and send money through them.

Best ways to receive payouts from Amazon

As an online seller based in Singapore / Australia but selling in the US and Europe, one of the first services needed was a payment solution to receive funds in the US and UK. For me, that includes disbursements from selling on Amazon.com, Amazon.co.uk, and Amazon Associate affiliate payouts.

This also applies to anyone selling cross-border, such as US based sellers wanting to sell in the UK, Europe, Australia, etc.; or UK based sellers wanting to sell outside of the UK.

Note: If you are a seller in the Eurozone, US, UK, Australia, New Zealand, India, Hong Kong or Canada, Amazon supports payouts directly into bank accounts in those countries (http://www.amazon.com/gp/help/customer/display.html?nodeId=200501140). However Amazon will convert into your home currency at the Amazon Currency Converter rate of 1.5%. The options on this page will help you save costs on FX margins / currency conversion fees, and maximize earnings.

The options:

This also applies to anyone selling cross-border, such as US based sellers wanting to sell in the UK, Europe, Australia, etc.; or UK based sellers wanting to sell outside of the UK.

Note: If you are a seller in the Eurozone, US, UK, Australia, New Zealand, India, Hong Kong or Canada, Amazon supports payouts directly into bank accounts in those countries (http://www.amazon.com/gp/help/customer/display.html?nodeId=200501140). However Amazon will convert into your home currency at the Amazon Currency Converter rate of 1.5%. The options on this page will help you save costs on FX margins / currency conversion fees, and maximize earnings.

The options:

- Incorporate in the countries you plan to sell in. For example if you want to sell in the US, then incorporate a US company an open a US bank account. Of the three options, this would be the most expensive and also require that you then file tax returns in the US (these could include corporate tax, income tax and sales tax). This also means you would have to hire a US CPA. However it is something to consider if you have considerable capital and revenue in the US or US tax rates are lower than in your local jurisdiction. This get even more complex if you plan on selling in multiple countries as it would mean having to setup a company and bank account in each country, which would become extremely cumbersome for a small business!

- Use the Amazon Currency Converter for direct disbursements into your home country bank account. While this is very simple, you lose 3 advantages compared to using 3rd party disbursement solutions; lower conversion rates, the ability to hold USD to pay suppliers in USD and therefore save on foreign exchange fees, and the ability to hold funds in USD to convert and transfer when the exchange rate is more favourable.

- Comparing and helping you choose 3rd party payment service providers to receive payment from Amazon, ebay, etc., is what this post is about. The services I have used are:

- Payoneer

- WorldFirst

- TransferWise

- OFX

- Airwallex

Payoneer Review

I started with Payoneer in late 2013 as it was the only solution I could find. Essentially Payoneer allows you to receive ACH transfers from US companies and SEPA transfers from EU companies, directly to your Payoneer Account. Payoneer's standard fees are

The process of registering a Payoneer account is pretty simple. Just sign up online and upload documentary proof of your ID and address. Then wait 2-3 weeks to receive your Payoneer debit card which you will need to activate the account using the card number. You then go into Amazon or whatever company you want you receive payments from and fill in the Payoneer bank account details.

My strategy for using Payoneer from 2013 to 2015 was to use it for funds that I wanted to reinvest into inventory purchases for selling on Amazon US. This is because Payoneer is transacted in USD so if I receive Amazon US payouts and use that to pay for inventory purchases in USD, I avoid two foreign currency transactions. With Payoneer I would lose 2% in fees (1% to receive and 1% on expenses). If I transferred back to my local currency and then purchased inventory in USD with my local SGD credit card, total fees would be at least 4% or more due to 2x currency conversion.

Additionally, Payoneer comes with a debit card that is useful to pay suppliers who accept card payments in USD. But having a debit card has pros and cons, as explained in the next paragraph.

So I like Payoneer for reinvestment of capital. However something happened this week (Mar 2015) which made me dissatified with Payoneer's system. There was an unauthorized charge on my Payoneer card and Payoneer duly blocked the transaction and deactivated the card, which was good. However I have to pay $12.95 for a new card to be sent to me. This will take 2-3 weeks and in the meantime my account is completely frozen. Sure I understand that I cannot use the debit card, till the new card gets here, but I can't even receive payments that are made to the Payoneer bank account! I felt this was ridiculous and contacted Payoneer customer service. Apparently that's just the way it is - all functions are blocked till I reactivate the account by keying in the new MasterCard info which I will only have when the card arrives. That resulted in my last Amazon payout to Payoneer bouncing which is terrible for my cash flow and repurchasing. So a few thousand in the account is stuck and an incoming deposit bounced. That's over $10,000 in sourcing money stuck!

Since I also like to purchase only 1-2 months worth of stock at a time, that also means I am low on inventory! Lesson learnt? Use WorldFirst more together with local credit cards that give big cashback or rewards to offset the higher transaction costs for currency exchange.

Payoneer Pros:

- 1% of each payment received using the service

- 1% of each payment made using the Payoneer debit card

- 2% lower foreign currency exchange rate to transfers/withdraw funds to your local currency

- $29.95 annual fee

The process of registering a Payoneer account is pretty simple. Just sign up online and upload documentary proof of your ID and address. Then wait 2-3 weeks to receive your Payoneer debit card which you will need to activate the account using the card number. You then go into Amazon or whatever company you want you receive payments from and fill in the Payoneer bank account details.

My strategy for using Payoneer from 2013 to 2015 was to use it for funds that I wanted to reinvest into inventory purchases for selling on Amazon US. This is because Payoneer is transacted in USD so if I receive Amazon US payouts and use that to pay for inventory purchases in USD, I avoid two foreign currency transactions. With Payoneer I would lose 2% in fees (1% to receive and 1% on expenses). If I transferred back to my local currency and then purchased inventory in USD with my local SGD credit card, total fees would be at least 4% or more due to 2x currency conversion.

Additionally, Payoneer comes with a debit card that is useful to pay suppliers who accept card payments in USD. But having a debit card has pros and cons, as explained in the next paragraph.

So I like Payoneer for reinvestment of capital. However something happened this week (Mar 2015) which made me dissatified with Payoneer's system. There was an unauthorized charge on my Payoneer card and Payoneer duly blocked the transaction and deactivated the card, which was good. However I have to pay $12.95 for a new card to be sent to me. This will take 2-3 weeks and in the meantime my account is completely frozen. Sure I understand that I cannot use the debit card, till the new card gets here, but I can't even receive payments that are made to the Payoneer bank account! I felt this was ridiculous and contacted Payoneer customer service. Apparently that's just the way it is - all functions are blocked till I reactivate the account by keying in the new MasterCard info which I will only have when the card arrives. That resulted in my last Amazon payout to Payoneer bouncing which is terrible for my cash flow and repurchasing. So a few thousand in the account is stuck and an incoming deposit bounced. That's over $10,000 in sourcing money stuck!

Since I also like to purchase only 1-2 months worth of stock at a time, that also means I am low on inventory! Lesson learnt? Use WorldFirst more together with local credit cards that give big cashback or rewards to offset the higher transaction costs for currency exchange.

Payoneer Pros:

- Quick, simple setup.

- Ability to receive funds from many sources and transfer to your foreign bank account.

- Ability to minimize foreign currency transaction fees if receiving funds in the US and using the Payoneer debit card to fund purchases.

- Inefficient system that does not separate functions. Once one goes down, everything goes down.

- Does not have Xero integration, which is a deal breaker for me.

WorldFirst Review

After a year of using Payoneer only, I decided to also open an account with WorldFirst in Oct 2014. My reasons were:

As it turned out, I'm glad I have a WorldFirst account as my Payoneer bridge did get blown up and will take 2-3 weeks to rebuild.

I have 2 WorldFirst accounts, one in USD and one in GBP. Since Jan 2015, I have been alternating Amazon US payouts between Payoneer and WorldFirst. The former for reinvestment and the latter to pay myself and develop other income streams.

I also started selling on Amazon UK in the middle of 2014 and it is far lower cost to receive GBP payoutsto my WorldFirst GBP account then to my Singapore bank account vs having Amazon UK convert GBP to USD and payout to Payoneer at Amazon's conversion rate of about 4%.

The main thing to note about WorldFirst is that it specializes specifically in low-cost foreign currency transactions. WorldFirst only makes money through currency conversion when you withdraw funds into your local bank account. This has a number of useful applications for sellers like me who are not based in either the US or UK. It is also useful for a US based seller who sells in the UK or a UK based seller selling in the US.

Unlike Payoneer, there is no debit card facility. This has its pros and cons. It means there is only one function - receive funds in the US or UK, convert and transfer them to your local bank account. This keeps it simple and minimizes potential complications as happened to my Payoneer account. WorldFirst also is the lowest cost way I know of to receive my USD and GBP payouts into my SGD bank account.

- Lower foreign exchange costs (2 to 2.5%) vs Payoneer (1% + 2.75%). Update: WorldFirst has revised rates down, and the spread now starts from as low as 1% to 2.5%. I know because they just changed my rate to 1%! :)

- I started selling on Amazon.co.uk and wanted a more efficient way to transfer payouts to Singapore .

- I like to have multiple options so I have alternatives in case something goes wrong. As an ex-military demolitions sergeant, I always use the analogy of having more than one bridge so you are not trapped if one gets blown up.

As it turned out, I'm glad I have a WorldFirst account as my Payoneer bridge did get blown up and will take 2-3 weeks to rebuild.

I have 2 WorldFirst accounts, one in USD and one in GBP. Since Jan 2015, I have been alternating Amazon US payouts between Payoneer and WorldFirst. The former for reinvestment and the latter to pay myself and develop other income streams.

I also started selling on Amazon UK in the middle of 2014 and it is far lower cost to receive GBP payoutsto my WorldFirst GBP account then to my Singapore bank account vs having Amazon UK convert GBP to USD and payout to Payoneer at Amazon's conversion rate of about 4%.

The main thing to note about WorldFirst is that it specializes specifically in low-cost foreign currency transactions. WorldFirst only makes money through currency conversion when you withdraw funds into your local bank account. This has a number of useful applications for sellers like me who are not based in either the US or UK. It is also useful for a US based seller who sells in the UK or a UK based seller selling in the US.

Unlike Payoneer, there is no debit card facility. This has its pros and cons. It means there is only one function - receive funds in the US or UK, convert and transfer them to your local bank account. This keeps it simple and minimizes potential complications as happened to my Payoneer account. WorldFirst also is the lowest cost way I know of to receive my USD and GBP payouts into my SGD bank account.

TransferWise Review

Note: TransferWise is changing their name to Wise. I no longer use TransferWise because it is NOT an approved Amazon Payment Service Provider. Furthermore Airwallex provides everything Wise has several other better features, a much faster receiving time for payouts from Amazon, and has lower fees.

I've been using TransferWise as a complement to World First in the last 2 or 3 years.

I like to use both for different reasons.

I use World First when the transfer involves a currency conversion, because World First has the lowest forex spread (exchange rate). World First can also be used to transfer USD to a USD account, such as to a supplier, where no currency conversion is involved. World First's fixed fee for USD-USD transfers is USD15.

TransferWise has a slightly higher forex spread of 0.4-0.6 compared to 0.15-0.50 for World First. However TransferWise fixed fee for USD to USD bank transfers is lower at USD1.40 when transferring to a bank account in the US, and USD4.60 when transferring to a USD bank account outside the US, such as a supplier's USD bank account in China, Thailand, etc.

Practically, I switch my Amazon payouts to deposit into World First when I want to transfer it back to my local currency, and to TransferWise where I keep an operating cash balance that's used to pay USD to suppliers.

I've been using TransferWise as a complement to World First in the last 2 or 3 years.

I like to use both for different reasons.

I use World First when the transfer involves a currency conversion, because World First has the lowest forex spread (exchange rate). World First can also be used to transfer USD to a USD account, such as to a supplier, where no currency conversion is involved. World First's fixed fee for USD-USD transfers is USD15.

TransferWise has a slightly higher forex spread of 0.4-0.6 compared to 0.15-0.50 for World First. However TransferWise fixed fee for USD to USD bank transfers is lower at USD1.40 when transferring to a bank account in the US, and USD4.60 when transferring to a USD bank account outside the US, such as a supplier's USD bank account in China, Thailand, etc.

Practically, I switch my Amazon payouts to deposit into World First when I want to transfer it back to my local currency, and to TransferWise where I keep an operating cash balance that's used to pay USD to suppliers.

OFX Review

In early 2021, I started using OFX due to several reasons.

- They reached out to me and offered a very low preferential currency conversion rate.

- WorldFirst just raised their FX margin rates in February 2021, which makes it higher than OFX's preferential rate.

- TransferWise is not in Amazon's PSP program. Amazon implemented their Payment Service Provider (PSP) program on March 1st, 2021. Payment service providers that are NOT in Amazon's PSP program will be subject to a longer disbursement reserve of up tp 21 days, instead of the normal 7 day reserve (Amazon holds sales proceeds in reserve in case of customer refunds. The reserve period is calculated from the day an ordered is delivered). This means a 14 day cash flow delay if you use a non-PSP 3rd party payment provider.

- OFX integrates with Xero, which is important for me as that's what my accountant uses.

|

Payoneer |

WorldFirst |

TransferWise (Wise) |

OFX |

Airwallex |

FX Margin (Currceny Conversion Rate) |

1.2% VIP flat rate |

0.6% if annual transfer total <AUD/SGD750k |

0.43% (≥USD20k per transfer) 0.498% (USD1k) 0.78%(USD200) |

0.3% preferential flat rate |

0.3% preferential flat rate |

Same currency payment from account balance (for example USD to USD) |

2% to bank accounts. Free to other Payoneer accounts. |

USD15 flat fee |

USD1.05 recipient in US USD4.25 recipient in China |

0.3% |

Zero to recipients in US. Low flat fee for international transfers. |

Amazon Payment Service Provider (PSP) |

Yes |

Yes |

No |

Yes |

Yes |

Xero Integration |

No |

Yes |

Yes |

Yes |

Yes |

Conclusion: Payoneer, World First, TransferWise, OFX or Airwallex?

With effect from 2022, I I have switched to Airwallex to receive my Amazon payouts and to pay my suppliers due to the following reasons:

- Lowest FX margin / currency conversion rate of 0.3%. WorldFirst would be lower (0.2%) only if you transfer more than AUD/SGD7.5 million annually. To put this in perspective, an Amazon seller would need to sell approximately $15 million per year to transfer $7.5 million in payouts from Amazon. Therefore WorldFirst's lowest rate is not applicable to 99% of sellers. And if you do transfer such high volumes, you can negotiate for a lower rate.

- Airwallex is an official Amazon's Payment Service Provider (PSP).

- Convenience of creating and paying with Airwallex debit card. I use this to pay my 3PL and various other service providers. It saves on currency conversion fees and also makes bookkeeping easier as Airwallex is synced to my Xero account.

Finally, you might be from a country where some of these options are not available. In that case, pick what is available to you.

|

3rd choice

|

Not recommended for Amazon sellers.

|